Pet insurance is an important topic of discussion for all pet owners, but one that can often seem complicated and difficult to navigate.

The answer to whether pet insurance is worth it depends on several factors, including the type of coverage, deductibles and co-pays, age and breed of pet, and more.

What is Pet Insurance?

Pet insurance is a type of health insurance for your furry friends that can help cover the costs of unexpected illnesses, accidents, and injuries.

Just like with human health insurance, pet owners pay a monthly premium to their chosen provider in exchange for coverage.

With pet insurance, you can take your pet to any licensed veterinarian and receive reimbursement for covered expenses.

This can include everything from routine check-ups and vaccinations to emergency surgeries and hospital stays.

There are many different types of pet insurance plans available, each with its own unique benefits and coverage options.

Some plans may cover only accidents and illnesses, while others may also include wellness care or alternative therapies.

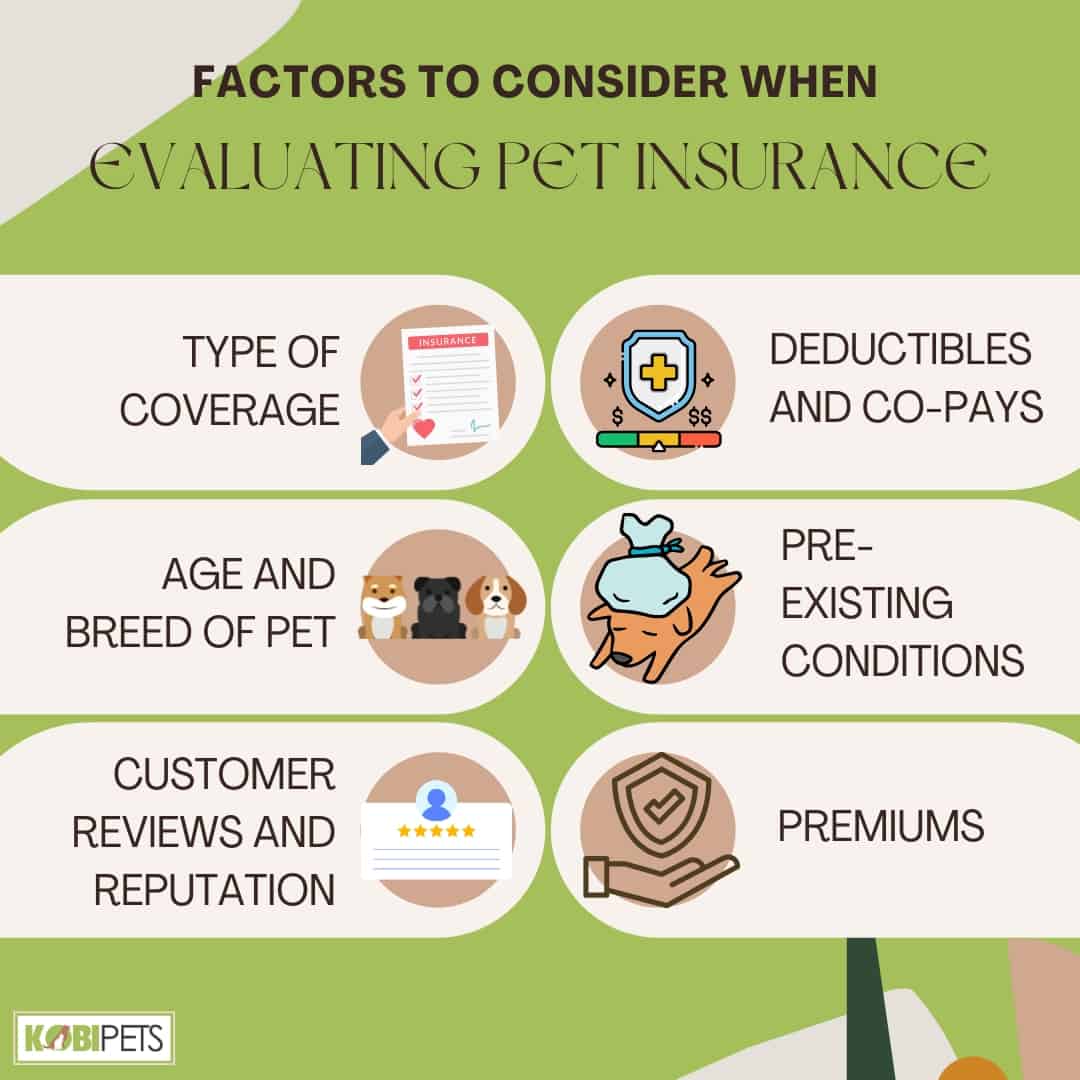

Factors to Consider When Evaluating Pet Insurance

When considering whether pet insurance is worth it, there are several factors that should be taken into account.

Here are some key factors to consider when evaluating pet insurance:

- Type of Coverage: Pet insurance policies can vary in terms of what they cover. Some policies only cover accidents, while others cover both accidents and illnesses. Some policies also include coverage for routine care, such as annual checkups and vaccinations. It is important to carefully review the policy details to understand what is covered and what is not.

- Deductibles and Co-Pays: Pet insurance policies often have deductibles and co-pays, which can affect the overall cost of the policy. Higher deductibles and co-pays can mean lower monthly premiums, but can also result in higher out-of-pocket expenses when a claim is filed.

- Age and Breed of Pet: The age and breed of a pet can also impact the cost and availability of pet insurance. Older pets and certain breeds may be more expensive to insure or may have limited coverage options.

- Pre-Existing Conditions: Many pet insurance policies do not cover pre-existing conditions, so it is important to consider any existing health issues when evaluating pet insurance options.

- Customer Reviews and Reputation: Before selecting a pet insurance provider, it is a good idea to research customer reviews and the company’s reputation. This can provide insight into how easy it is to file a claim and how well the company handles claims.

- Premiums: The monthly premiums for pet insurance policies can vary widely depending on the level of coverage and the age and breed of the pet. It is important to consider whether the cost of the policy fits within your budget.

Factors to Consider When Evaluating Pet Insurance

Cost vs. Benefit Analysis of Pet Insurance

Pet insurance is a topic that has been gaining popularity in recent years, with many pet owners wondering whether it’s worth the cost.

While the average yearly cost of pet insurance varies depending on the type of coverage and your pet’s age, breed, and health status, it’s important to consider the potential benefits and drawbacks before making a decision.

On one hand, having pet insurance can provide peace of mind knowing that you’ll be able to afford unexpected veterinary bills if your pet gets sick or injured.

This can be especially helpful for those who may not have enough savings to cover large expenses all at once. Additionally, some policies may cover routine care such as vaccinations and wellness exams.

| Factor | Cost of Pet Insurance | Benefit of Pet Insurance |

|---|---|---|

| Accidents and Illnesses Coverage | $50-$100 per month, depending on coverage level | Covers unexpected veterinary expenses for accidents and illnesses |

| Routine Care Coverage | Additional $10-$20 per month | Covers routine care expenses such as checkups and vaccinations |

| Deductibles and Co-Pays | Varies depending on the policy | Can lower monthly premiums, but result in higher out-of-pocket costs |

| Age and Breed of Pet | Older pets and certain breeds may have higher premiums or limited coverage options | Provides peace of mind and financial protection for unexpected health issues |

| Pre-Existing Conditions | Typically not covered | Provides coverage for new health issues that may arise |

| Customer Reviews and Reputation | N/A | Provides peace of mind and assurance that claims will be handled efficiently |

| Total Cost | Varies depending on policy and pet | Can potentially save thousands of dollars in unexpected veterinary expenses |

Potential Risks of Not Having Pet Insurance

As a pet owner, it’s important to consider the potential risks of not having pet insurance. Here are some of the risks you may face:

- Financial burden: Without pet insurance, you’ll be responsible for paying all of your pet’s medical bills out of pocket. This can quickly become expensive, especially if your pet requires emergency care or major surgery.

- Limited access to veterinary care: If you can’t afford to pay for your pet’s medical care, you may be forced to limit the amount of care they receive. This could result in your pet not receiving the necessary treatments or medications.

- Delayed treatment: Without insurance, you may delay taking your pet to the vet due to financial concerns. This could lead to their condition worsening and requiring more extensive (and expensive) treatment later on.

- Stress and worry: Knowing that you don’t have insurance to cover unexpected medical expenses for your pet can cause stress and worry. You may find yourself constantly worrying about what would happen if your pet got sick or injured.

In short, not having pet insurance can put both you and your furry friend at risk. By investing in a good policy, you can ensure that your pet receives the best possible care without breaking the bank.

Potential Risks of Not Having Pet Insurance

Choosing the Right Pet Insurance Policy

As a pet owner, you want to ensure that your furry friend is always healthy and happy. However, unexpected illnesses or accidents can happen at any time, leading to costly vet bills.

This is where pet insurance comes in handy. With the right policy, you can have peace of mind knowing that your pet’s medical expenses will be covered.

Consider the Type of Coverage You Want

When choosing a pet insurance policy, you need to decide what type of coverage you want for your pet.

Some policies only cover accidents and emergencies, while others also include wellness care and routine check-ups.

It’s important to consider the specific needs of your pet when deciding on a coverage.

Evaluate the Cost of the Policy

Another important factor to consider is the cost of the policy. You want to make sure that the monthly premium fits within your budget and that you understand any deductibles or co-pays associated with the policy.

Keep in mind that cheaper policies may not cover as much or may have higher out-of-pocket costs.

Research Different Providers

It’s essential to research different providers and read reviews from other pet owners. Look for a provider with a good reputation for customer service and timely claims processing.

Consider reaching out to each provider directly with any questions you may have about their policies.

Read Through the Policy Details Carefully

Before signing up for a pet insurance policy, make sure to read through all of the details carefully. Pay attention to things like exclusions, waiting periods, and pre-existing conditions.

Make sure you fully understand what is covered under the policy before committing.

Alternatives to Pet Insurance

One alternative is a veterinary discount plan like Pet Assure. With Pet Assure, you can save up to 25% on veterinary bills for a low monthly fee.

This option is great for those who want to save money on routine check-ups and preventative care.

Another alternative is a community health-sharing plan like Eusoh. Eusoh allows members to share the cost of their pets’ medical expenses with other members of the community.

This option is ideal for those who want a more affordable way to cover unexpected medical costs.

Crowdfunding platforms like GoFundMe are also an option for those who need help covering their pets’ medical bills.

By creating a fundraising campaign, friends and family can lend a helping paw toward your vet bills.

Lastly, self-insuring or setting up an emergency fund can be another alternative to traditional pet insurance. By setting aside money each month into an emergency fund, you’ll have peace of mind knowing that you have funds available in case of an emergency.

In conclusion

After weighing the risks and benefits, it is ultimately up to you to decide whether pet insurance is worth it for your pet and family.

Consider taking the time to research different policies and plans that are available, so that you can choose an insurance plan specific to your pet’s needs.

If you determine that pet insurance offers enough value to justify the cost, then it could provide both financial and peace of mind protection for pet owners.